Social Markets

Social Markets

As we have noted above, open-source software (OSS) is one of the most dynamic ⿻ ecosystems in the world. Yet, because software is made freely available, it has long struggled for reliable sources of funding. At the same time, many public and charitable funders see value in the ecosystem but find it hard to navigate what projects to support given the heterogeneity of the ecosystem compared, say, to traditional academic research.

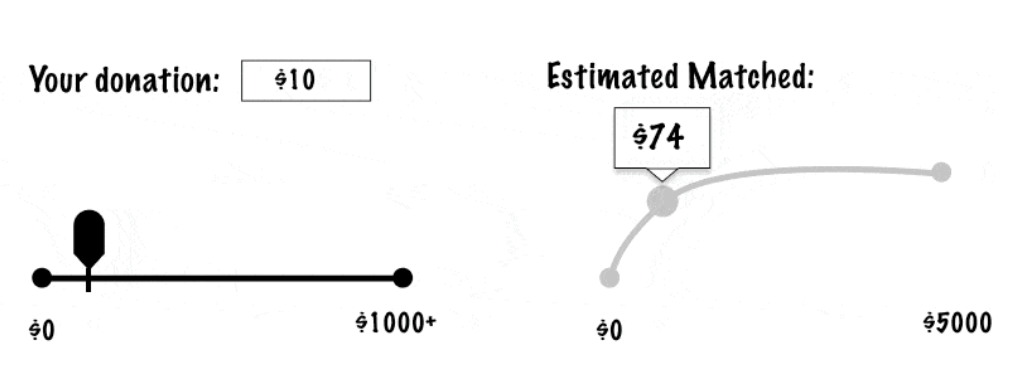

Recent attempts to overcome this challenge have focused on matching funds and community donations, where a sponsor supports a class of projects, but this pool of funds is directed by the small donations of participants in the projects. Traditionally such systems (such as GitHub Sponsors) could be manipulated by wealthy participants (such as corporations), whose donations could command most matching funds.

To overcome this, a number of new matching platforms, such as GitCoin Grants, connect sponsors (small donors and grants) using a "plural funding" formula that accounts not just for the total funding received, but also the diversity of its source across individual contributors and connected social groups. These platforms have become important sources of funding for OSS, channeling in total more than a hundred million dollars in funding. This has been especially important to Web3 related projects, in Taiwan, and in supporting this book. They are also increasingly being applied to domains (e.g. environment, local business development) outside OSS.

No institutions connect more people across broader social diversity in collaborative exchange than those of global capitalism. The limited remit and strength of international governance create severe limits on the ability to provide transnational public goods through voting and deliberation, but the almighty dollar (and yuan) is respected in most corners of the planet. Capital flows and the technology it is invested in shape lives around the world. International trade and other commercial agreements are among the strongest and nearly universally respected agreements. Private ownership has become a far more consistent pattern across the planet than any other feature of the "rule of law".[1] Since the fall of the Soviet Union, while national borders have hardly budged and few new nations have been born, companies like Amazon, Google and Meta have arguably grown to a position of prominence around the planet exceeding all but a handful of nation states.

At the same time, for all the elaborate financial and corporate structures built on top of them, markets are perhaps the most simplistic structure conceivable as a pattern for human cooperation. While they can be applied more broadly, as we will see, the argument for their desirability rests on a vision of bilateral transactions between a buyer-seller pair, each of which is representative of a sea of similarly situated and thus equally powerless buyers and sellers, all engaging in a transaction whose effects are bounded by a predetermined set of private property rights that avoid any "externalities" on non-transacting parties. Any notion of emergent, surprising, group level effects, of supermodularity and shared goods, of heterogeneity, or of diversity of information are bracketed as "imperfections" or "frictions" that impede the natural, ideal functioning of markets.

This debate has been at the core of the conflict over capitalism, long before its ascendancy, as documented by social scientist Albert Hirschman.[2] On the one hand, markets have been seen to be almost uniquely universally "civilizing", alleviating the potential for conflict across social groups, and "dynamic", allowing entrepreneurship to create new forms of large scale social organization that foster and support (social) innovation.[3] On the other hand, markets are poor at supporting the flourishing of other forms of scaled social interaction. They corrode many of the other technologies of collaboration we describe. While allowing the creation of some new forms, they tend to turn these into exploitative, socially irresponsible, and often reckless monopolies. In this chapter we will explore this paradox and how radical new forms of markets, like those we described above, can maintain, and extend this inclusive and dynamic character while fostering a far more diverse range of rich human collaboration.

Capitalism today

Capitalism is typically understood as a system based on private property in the means of production, voluntary market-based exchange, and free and vigorous operation of the profit motive from this starting point. Global capitalism today (sometimes called "neoliberalism") features several interlocking sectors and features, including:

- Free trade: Extensive free trade agreements, overseen by organizations such as the World Trade Organization, ensure that a wide range of goods can flow mostly unimpeded across jurisdictions covering most of the planet.

- Private property: Most real and intellectual assets are held as private property, conferring joined rights of use, disposal, and profit. These rights are protected by international territorial and intellectual property treaties.

- Corporations: Most large-scale collaborations using extra-market governance are undertaken either by nation states or by transnational corporations that are operated for profit, owned by shareholders, and governed by the principle of one-share-one-vote.

- Labor markets: Labor is based on the idea of "self-ownership" and the wage system, with some important qualifications. People are generally not free to move across jurisdictional boundaries to work.

- Financial markets: Shares in corporations, loans and other financial instruments are traded on sophisticated financial markets that allocate capital to projects and physical investments based on projections of the future.

- Ventures and start-ups: New corporations and thus most new forms of large-scale international cooperation come into existence through a system of "venture capital", where "start-ups" sell shares in their potential future earnings or resale value to public markets in exchange for the funding they need to begin a new business.

Many textbooks have been written, including some by some of our close friends, on this structure.[4] It is hard to doubt that it is one of the most powerful modes of cooperation humans have ever devised and has been central to the unprecedented progress in material conditions around the world in the last two centuries. Furthermore, the most famous theoretical results in economics are the "fundamental welfare theorems", which assert that under certain conditions markets lead selfish individuals "by an invisible hand" to serve the common good.[5] Yet the conditions and scope of this result are quite circumscribe, which is why capitalism has so many familiar problems.

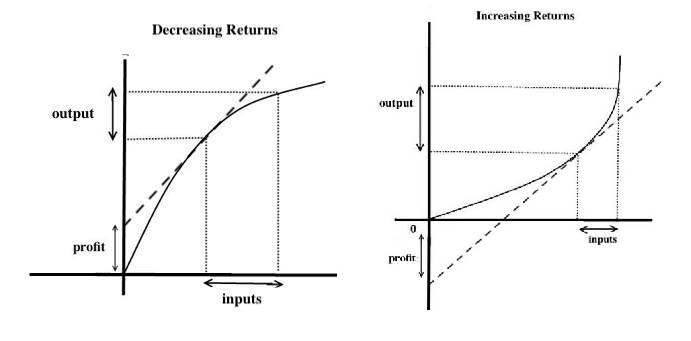

- Increasing returns and public goods: Perhaps the most restrictive condition, highlighted by the founding fathers of the "marginal revolution" that ushered in modern economics, is "decreasing returns", the opposite of the supermodularity we used to define collaboration. This requires that production have "decreasing marginal returns" or more generally and less formally, that "the whole is less than the sum of its parts". Only then can profitable production be consistent with the principle of, for example, paying workers their marginal contributions to production; when there are increasing returns, paying everyone their marginal product yields a loss, as shown in Figure C. Public goods that benefit a large number of people at little additional cost and are hard to stop people from using are an extreme case and economists have long argued that markets dramatically under-supply these. But even less extreme cases of increasing returns/supermodularity are severely under-provided by capitalism. Nobel Prizes, among others, to Paul Romer and Paul Krugman for showing how fundamental these goods are to growth and development.[6] In short, perhaps the greatest paradox of global capitalism is that it is at once the largest scale example of collaboration and yet has trouble precisely supporting the forms of technological collaboration that it heralds.

- Market power: In some cases where exclusion from shared goods can be imposed by barriers or violence, funding of such collaboration can be partially alleviated by charging for access. But this tends to create monopolistic control that concentrates power and reduces the value created by scaling collaboration, undermining the very collaboration it aims to support.

- Externalities: At the core of John Dewey's 1927 classic The Public and its Problems, is recognizing the genius of innovation to create new forms of interdependence, both for good and ill.[7] The motors of the nineteenth century transformed human life, yet also turned out to transfigure the environment in unanticipated ways. Radio, flight, chemicals...all redesigned how we can cooperate, but also created risks and harms that previous systems of "property rights" and rules generally did not account for. The victims (or in some cases beneficiaries) of these "externalities" are, by construction, not directly partly to market transactions. Thus, precisely to the extent that new means of collaboration developed in markets are revolutionary, markets and the corporations they spawn will not directly involve those affected by their innovations, preventing either their benefits from being fully tapped or their risks from being mitigated.

- Distribution: Theoretically, markets are simply indifferent to distribution and "endowments" can be rearranged to achieve desired distributive goals. But achieving this ideal redistribution faces enormous practical hurdles and thus markets tend to often yield shockingly inegalitarian outcomes, sometimes for reasons fairly divorced from their alleged "efficiency" benefits. In addition to the direct concerns these create, they also often help undermine the greater equality often assumed or harnessed in other collaborative forms described in previous chapters.

Recognition of and response to these challenges are arguably the leading currents of the politics of the last hundred and fifty years in much of the world, so we must review them only very superficially.

- Antitrust and utility regulation: A primary focus of the populist movement of the late nineteenth century and early twentieth in the US was the restraint of the power of corporate monopolies using a mixture of structural (e.g. corporate break-ups or prevention of mergers) or behavioral (e.g. price or non-discrimination regulation) interventions.[8] While these help address some of the abuses of monopoly, they often do so at the cost of reducing the advantages of collaboration (scale) and/or by reintroducing the rigidities of nation-state based governance that it is the great advantage of entrepreneurship to help transcend.

- Labor unions and cooperatives: An alternative approach to addressing market power has been the creation of corporate governance modes that try to give voice to those over whom a company holds power. Powerful unions are created to "countervail" the labor market power of firms and enable customer or worker representation in company governance through cooperative or "codetermination" structures.[9] While these have been some of the most vibrant and effective correctives to corporate power, they have been limited primarily to a traditional model of full-time employment that has struggled to keep pace with the dynamism and internationalism of labor markets and the diversity of collaboration in the digital age.

- Eminent domain/compulsory purchase and land/wealth taxes: To address smaller-scale market power (e.g. over land and specific pieces of wealth), many jurisdictions have rights of "eminent domain" or "compulsory purchase" allowing the forced repurchase of private property with the support of public authorities, usually with compensation and subject to judicial review. Some jurisdictions also charge taxes on land, wealth or inheritance to both reduce inequality and help increase the circulation of assets away from those who might monopolize them. While crucial to social equity and development, these approaches rely heavily on often fragile administrative processes to reach equitable valuations.

- Industrial, infrastructure and research policy: To overcome the tendency of markets to underfund public goods and more generally supermodular collaboration, many governments provide funding for infrastructure (e.g. transportation, communications, electrification), research and development of new technologies and the development to scale of new (for the country) industries. While critical to technical, industrial, and social progress, these investments struggle to span national borders in the way capitalism does and are often administered by bureaucracies with far less information that the participants in the fields they support have.

- Open source, charity and the third sector: A more flexible approach to similar goals is the "third" or "social" sector efforts including charity and volunteer effort (like the OSS community) that build scalable collaboration on a voluntary, non-profit basis. While they are among the most dynamic forms of scaled collaboration today, these efforts often struggle to scale and sustain themselves given the lack of financial support from the most powerful market and government institutions.

- Zoning and regulation: The risk of markets failing to account for external harms and benefits are generally addressed by government-imposed restrictions on market activity, usually called "regulation" at broader levels and "zoning restrictions" on more local levels. Occasionally, especially in environmental matters, economists' preferred solutions of "Pigouvian" taxes or tradeable permits are used. While these restrictions are the central and thus indispensable way to address externalities, they are beset by all the limits of rigid, nation-state- (or corresponding local justification) based decision-making we discussed above, and given their economic stakes are often captured/controlled by interest groups imperfectly aligned to the interests of even the supposedly relevant public.[10]

- Redistribution: Most developed capitalist nations have extensive systems of taxation of income and commerce that fund, among other things, social insurance and public welfare schemes that ensure the availability of a range of services and fiscal support as a check against extreme inequality. In contrast to the promise of land and wealth taxes, however, these primary income sources generally partly impedes the functioning of markets, struggle to extract many of the most runaway fortunes and only imperfectly correct the structural ways inequality impedes other forms of collaboration.

The limitations of these solutions are so widely understood that they led to a significant backlash in many countries beginning in the 1970s, the so-called "neoliberal reaction". Yet the limits of markets persist and there has been a resurgence in the last decade of both of these solutions, but also of creative attempts to transcend them and avoid many of the trade-offs they create.

Social markets tomorrow

As we highlighted in the Connected Society chapter above, the desire to combine and even enhance the dynamism of markets while at the same time addressing their limits was a primary motivation for ⿻, especially the thought of Henry George and his followers, including economics Nobel Laureate William Vickrey, to whom the previous book written by one of the authors of this one was dedicated.[11] Vickrey pioneered the economics subfield of "mechanism design", which explores these possibilities and has led to many of the creative possibilities that have been deployed in the past decades.

- Partial common ownership: To overcome the challenges of administering land taxes, a variety of historical thinkers, including Founder of the Chinese Republic Sun Yat-Sen (who we discussed extensively in our A View from Yushan chapter) and economist Arnold Harberger, have proposed having owners self-assess the value of their property under penalty of having to sell at this self-assessed value.[12] This has the simultaneous effect of forcing truthful valuations for taxation and of forcing turnover of underutilized or monopolized assets to broader publics. It is particularly easy to enforce in digital asset registries, such as blockchains, and thus has gained popularity in recent years, especially for non-fungible token (NFT) art works, as well having been used for many years for land in Taiwan.[13]

- Quadratic and ⿻ funding: As described at the start of this chapter, a natural way to fund public/supermodular goods without relying excessively on the limited knowledge of administrators is for such an administrator, philanthropist, or public authority to match contributions by distributed individuals. Mechanism design theory, similar to the logic supporting quadratic voting in the previous chapter, can be used to show that under similar assumptions of atomized behavior, matching funds should be proportioned to the square of the sum of square roots of individual contributions, giving greater weight to a large number of small contributors than to a few large ones.[14] Recently designs have stretched beyond traditional individualistic designs to account for ⿻ group interests and affiliations.[15]

- Stakeholder corporation: While partial common ownership and quadratic funding may help ensure the turnover of organization and asset control, they do not directly ensure that organizations serve rather than exercising illegitimate power over their "stakeholders", such as customers and workers. Drawing on the traditions we described above, there a variety of renewed movements in recent years to create a "stakeholder" corporation, including Environmental, Social and Governance principles, the platform cooperativism, the distributed autonomous organizations (DAOs), "stakeholder remedies" in antitrust (viz. using antitrust violations to mandate abused stakeholders have a voice), data unions and the organization of many of the most important large foundation model companies (e.g. OpenAI and Anthropic) as partial non-profits or long-term benefit corporations.[16]

- Participatory design and prediction markets: Digital platforms and mechanisms are also increasingly used to allow more dynamic resource allocation both within corporations and in connections between corporations and their customers.[17] Examples include ways for customers to contribute and be rewarded for new product designs, such as in entertainment platforms like Roblox or Lego Ideas, and prediction markets where stakeholders can be rewarded to predict company-relevant outcomes like sales of a new product.

- Market design: The field of market design, for which several Nobel Prizes have recently been awarded, applies mechanism design to create market institutions that mitigate problems of market power or externalities created by ignoring the social implications of transactions. Examples include markets for tradable carbon permits, the auction design examples we discussed in the Property and Contract chapter above and a number of markets using community currencies or other devices to facilitate market-like institutions in communities (e.g. education, public housing or organ donation) where using external currency can severely undermine core values.[18]

- Economies esteem: Related to these local currency markets are online systems where various quantitative markers of social esteem/capital (e.g. badges, followers, leaderboards, links) partly or fully replace transferable money as the "currency" of accomplishment.[19] These can often, in turn, partly interoperate with broader markets through various monetization channels such as advertising, sponsorship and crowdfunding.

While this blossoming of alternatives to simplistic markets is a powerful proof of concept for moving beyond the traditional limits of the market. But they represent the beginning, not the end, of the possibilities for the technologically enabled social markets of the future.

Frontiers of social markets

Building off these experiments, we are just able to glimpse what a comprehensively transformed market system might look like. Some of the most promising elements include:

- Circular investment: One of the most remarkable results of economic theory is named after Henry George. Proved originally by Vickrey but first published by Richard Arnott and Nobel Laureate Joseph Stiglitz, the Henry George Theorem states, roughly, that the taxes that can be raised from correctly designed common ownership taxes can fund all the subsidies required to fund supermodular investments.[20] While the result is much more general, a simple illustration is the way that building better local public schools tend to raise land values: if this value can be raised by a land tax, in principle any education investment worth funding can be supported. More generally, the result suggests a near limitless potential, like that realized in a superconducting circuit, for innovation in taxation/common property and allocation of funds to super-modular activity, to generate progress.

- ⿻ property: How can these funds be raised? While partial common property schemes are an interesting start, they need to be paired with tools that can recognize and protect common interests in the way and stability with which land and other assets are used. The voting systems we described in the previous chapter are a natural answer here and there may be great potential in ⿻ property systems that can bring these together, returning much of the value of a range of wealth to intersecting publics ("fructus") while also giving important access ("usus") and disposal ("abusus") rights to these communities.

- ⿻ funding across boundaries: ⿻ funding can also extend dramatically beyond its current bounds, to allocate the resources thus raised. Two of the most interesting directions are cross-jurisdictional and inter-temporal. Current international trade treaties focus primarily on breaking down trade barriers, including the subsidies that help support supermodular production as we discussed above. A future form of international economic cooperation could assemble matching funds for cross-jurisdictional economic ventures, harnessing a mechanism like ⿻ funding. One key advantage of capitalism is that it is one of the few scaled systems with a significant intertemporal planning component, where companies raise funds for profits that appear distant. One can imagine, however, even more ambitious inter-temporal economic systems with matching funds, for example, for institutions that promote cooperation across generations or with those who are not even born yet. This might overcome concerns about the lack of long-term planning, as well as the conservation of valued past institutions, in many quarters, creating an organic version of a "ministry for the future".[21]

- Emergent publics: Possibilities are equally promising for how the organizations thus supported can be made truly accountable to their stakeholders. Stakeholding of various kinds (as workers, customers, suppliers, targets of negative externalities like pollution dumping or misinformation, etc.) could be tracked by harnessing the type of ⿻ identity systems we discussed above. These could then be linked to participation using voting and deliberation systems like those we highlighted earlier in ways that are much less demanding on individuals' time and attention and able to more quickly reach broadly legitimate decisions than existing collective governance.[22] These in turn can make truly democratic and ⿻ governance of emergent publics a realistic alternative to traditional corporate governance. One could then imagine a future where new democratic entities governing emerging technologies in ways that are close to as legitimate as governments emerge as frequently as start-ups, creating a web of dynamic and legitimate governance.

- ⿻ management: Internally, it is also increasingly possible to see past the hierarchical structure that typically dominates corporate control. The Plural Management Protocol we used to create this book tracks the types and extent of contributions from diverse participants and harnesses mechanisms like we have described above to allow them to prioritize work (which then determines the recognition of those who address those issues) and determine which work should be incorporated into a project though a basis of exerting authority and predicting what others will decide.[23] This allows for some of the important components of hierarchy (evaluation by trusted authorities, migration of this authority based on performance according to those authorities) without any direct hierarchical reporting structure, allowing networks to potentially supplant strict hierarchies.

- Polypolitan migration policy: It is also increasingly possible to imagine breaking down the stringency of international labor markets through related mechanisms. As philosopher Danielle Allen has proposed, migration could be conditioned upon endorsement or support from one or more civil society groups in the receiving country, extending and combining existing practices in countries like Canada and Taiwan that respectively allow private community-based sponsorship and allow a diversity of qualifying pathways for long-term work permits.[24] These could diffuse the stringent control of labor mobility by nation states while maintaining accountability to avoid harms or challenges with social integration.

While these only begin to scratch the surface of possibilities, they hopefully illustrate how completely markets could be re-conceived harnessing ⿻ principles. While the debates over markets and the state often falls into predictable patterns, the possibilities for moving radically beyond this simplistic binary are just as broad as for any other area of ⿻.

Limits of social markets

Yet the potential of markets should not be mistaken for being a miracle cure or the primary pattern for the future of ⿻. Even in these greatly enriched forms, markets remain a thin shell that at best is able to comfortably fit and provide material support and interface for a diversity of richer human relationships, and at worst can undermine them. The best we can therefore hope for is to create market forms flexible enough that they fade into the background of the flowering of emergent social forms they support.

What we must guard against most rigorously is the tendency of markets to concentrate power in private organizations or limited cultural groups in ways that homogenize and erode diversity. Achieving this requires institutions that deliberately encourage new diversity, while eroding existing concentrations of power, like those we have highlighted. It also requires, as we have suggested, constantly bringing other forms of collaboration across diversity[25] to intersect with markets, whether voting, deliberation, or creative collaboration, while creating market systems (like ⿻ money) that can deliberately insulate these from broader market forces.

Yet despite all their manifest dangers and limitations, those pursuing ⿻ should not wish markets away. Something must coordinate at least coexistence if not collaboration across the broadest social distances and many other ways to achieve this, even ones as thin as voting, carry much greater risks of homogenization precisely because they involve deeper ties. Socially aware global markets offer much greater prospect for ⿻ than a global government. Markets must evolve and thrive, along with so many other modes of collaboration, to secure a ⿻ future.

Pistor, op. cit. ↩︎

Albert Hirschman, The Passions and the Interests, (Princeton: Princeton University Press, 1997). ↩︎

Joseph Schumpeter, Capitalism, Socialism and Democracy (New York: Harper & Brothers: 1942). Quinn Slobodian, Globalists: The End of Empire and the Birth of Neoliberalism (Cambridge, MA: Harvard University Press, 2018). ↩︎

Daron Acemoglu, David Laibson and John List, Economics (Upper Saddle River, NJ: Pearson, 2021). ↩︎

Adam Smith, An Inquiry into the Nature and Causes of the Wealth of Nations (London: W. Strahan and T. Cadell, 1776). ↩︎

Paul Krugman, "Scale Economies, Product Differentiation and the Pattern of Trade", American Economic Review 70, no. 5 (1980): 950-959. Paul Romer, "Increasing Returns and Long-Term Growth", Journal of Political Economy 94, no. 5 (1986):1002-1037. ↩︎

John Dewey, The Public and its Problems, op. cit. ↩︎

Matt Stoller, Goliath: The 100-Year War Between Monopoly Power and Democracy (New York: Simon & Schuster, 2020). ↩︎

John Kenneth Galbraith, American Capitalism: The Concept of Countervailing Power (New York: Houghton Mifflin, 1952). ↩︎

Edward L. Glaeser and Joseph Gyourko, "The Impact of Zoning on Housing Affordability" (2002) at https://www.nber.org/papers/w8835. ↩︎

Eric A. Posner and E. Glen Weyl, Radical Markets: Uprooting Capitalism and Democracy for a Just Society (Princeton, NJ: Princeton University Press, 2018). ↩︎

Sun, op. cit. Arnold C. Harberger, "Issues of Tax Reform for Latin America" in Joint Tax Program of the Organization of American States eds., Fiscal Policy for Economic Growth in Latin America (Baltimore, MD: Johns Hopkins Press, 1965). ↩︎

Emerson M. S. Niou and Guofu Tan, "An Analysis of Dr. Sun Yat-Sen's Self-Assessment Scheme for Land Taxation", Public Choice 78, no. 1: 103-114. Yun-chien Chang, "Self-Assessment of Takings Compensation: An Empirical Analysis", Journal of Law, Economics and Organization 28, no. 2 (2012: 265-285. ↩︎

Vitalik Buterin, Zoë Hitzig and E. Glen Weyl, "A Flexible Design for Funding Public Goods", Management Science 65, no. 11 (2019): 4951-5448. ↩︎

Ohlhaver et al., op. cit. and Miler et al., op. cit. ↩︎

Colin Mayer, Prosperity: Better Business Makes the Greater Good (Oxford, UK: Oxford University Press, 2019). Zoë Hitzig, Michelle Meagher, André Veig and E. Glen Weyl, "Economic Democracy and Market Power", CPI Antitrust Chronicle April 2020. Michelle Meagher, Competition is Killing us: How Big Business is Harming our Society and Planet - and What to Do About It (New York: Penguin Business, 2020). ↩︎

See Erich Joachimsthaler, The Interaction Field: The Revolutionary New Way to Create Shared Value for Businesses, Customers, and Society, PublicAffairs, 2019. See also Gary Hamel, and Michele Zanini, Humanocracy: Creating Organizations as Amazing as the People inside Them, (Boston, Massachusetts: Harvard Business Review Press, 2020). ↩︎

Atila Abdulkadiroğlu, Parag A. Pathak and Alvin E. Roth, "The New York City High School Match", American Economic Review 95, no. 2 (2005): 365-367. Nicole Immorlica, Brendan Lucier, Glen Weyl and Joshua Mollner, "Approximate Efficiency in Matching Markets" International Conference on Web and Internet Economics (2017): 252-265. Roth et al., op. cit. ↩︎

Nicole Immorlica, Greg Stoddard and Vasilis Syrgkanis, "Social Status and Badge Design", WWW '15: Proceedings of the 24th International Conference on World Wide Web (2015: 473-483. ↩︎

William Vickrey, "The City as a Firm" in Martin S. Feldstein and Robert P. Inman, eds., The Economics of Public Services: 334-343. Richard Arnott, and Joseph Stiglitz, “Aggregate Land Rents, Expenditure on Public Goods, and Optimal City Size,” The Quarterly Journal of Economics 93, no. 4 (November 1979): 471. https://doi.org/10.2307/1884466. ↩︎

Robinson, op. cit. ↩︎

An interesting first experiment in this direction is being undertaken by the Web3 protocol Optimism, which uses a mixture of one-share-one-vote and more democratic methods in different "houses" to govern its protocol. ↩︎

South et al., op. cit. ↩︎

Danielle Allen, "Polypolitanism: An Approach to Immigration Policy to Support a Just Political Economy" in Danielle Allen, Yochai Benkler, Leah Downey, Rebecca Henderson & Josh Simons, etc., A Political Economy of Justice (Chicago, IL: University of Chicago Press, 2022): ch. 14. ↩︎

Pooling across diversity is a very general principle. Although size matters, bigger is not always better, and the strength of the connections formed can matter more. For example, families, teams or troops – small networks connected by high-value interactions – can outperform much larger ones in the production of ⿻ goods. If we consider the record of Paleolithic art, banding together to perform key social functions is extremely ancient, so collaborative pooling at a range of scales, albeit by non-state and non-market actors, seems an exception to the rule that 'public goods' are always under-supplied. ↩︎